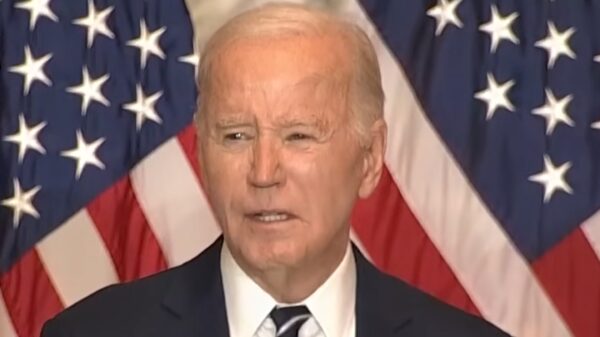

The Biden administration has proposed several tax hikes aimed at reducing racial wealth inequality, including increasing the capital gains and income tax rates, establishing a minimum tax on billionaires’ unrealized capital gains, and closing estate tax loopholes.

The Treasury argues these would disproportionately impact white families who hold more wealth in such assets.

Critics said raising taxes on capital will hurt the economy by reducing business investment and activity.

GOING STAGhttps://t.co/O1240CSl51

— Daily Caller (@DailyCaller) April 28, 2024

They argue the wealthy already pay their fair share and that higher taxes ultimately burden all income groups as costs are passed down.

“Taxing capital gains at 44.6% at the federal level — not to mention state taxes — would be economic suicide,” research fellow Preston Brashers said. “Before the tax ever took effect, investors would rush to pull their money out of equities subject to such exorbitant tax rates. U.S. businesses would be starved for capital, and business activity would slow to a crawl. Ultimately, corporate income and capital gains income would fall off a cliff, so the net result would be less tax revenue, not more. The middle class and working class would be slammed with mass layoffs and lower real wages.”

“So, if President Biden’s goal of redistribution is to make the rich poorer, his proposal would be successful,” Brashers said. “But if the goal is to lift up the middle class, the plan would fail spectacularly. Note, even the Urban-Brooking Tax Policy Center use estimates that imply that the revenue-maximizing long-term capital gains rate is about 28%, so it’s clear that Biden’s proposal is on the wrong side of the Laffer curve.”

While the proposals claim to address racial disparities, opponents view them as advancing the false Marxist notion that capital and labor are enemies, rather than recognizing their complementary roles in economic growth.

Concerns also exist that huge government spending is risking stagflation as debt continues rising rapidly under Biden.

“The wealthy already pay far more than their fair share, while the tax burden on large corporations ends up landing on individuals across the economy, including low-income individuals,” Kilts Family Chair in Fiscal Studies, Chris Edwards, said.

“Left-wing Biden economists seem unable to appreciate that raising taxes on capital hurts labor. Capital and labor work together to produce economic growth,” Edwards said. “They are complements. The Biden economists seem to hold the Marxist view that capital and labor are bitter enemies, and that the only way that labor can win is for the government to crush capital.”

“This hints at the false view that sadly underlies much of the Biden administration’s economic policy: high-earners only achieve success through luck, and low-earners can only achieve success through government handouts,” Edwards said. “That is an appalling, un-American view.”